WHO WANTS TO BE A BILLIONAIRE?

It’s a little odd to think of a rapidly growing, capital intensive business returning cash to shareholders through a buyback program, but that’s exactly what US cannabis operator Ayr Wellness announced last week. Investment community reaction has been mostly negative, with views including:

It’s going to restrain growth in the asset base

They’ll lose market share and won’t keep up with competitors

It’s just to scare off short sellers and won’t actually be used

I don’t think these are correct interpretations, and a look at the specific circumstances and incentives may help pin down the true intended effects.

To start, a few relevant background points:

The decision makers at the firm are predominantly ex-Wall Street1 and, to the best of my knowledge, have never expressed any particular passion for the plant as consumers. Which is fine! In fact, there are probably some institutional money managers out there who don’t want the stewards of their capital, well, getting high on their own supply.

On numerous occasions in the past, the CEO has expressed a capital management philosophy that prioritizes per share economics. Here’s how he described it nearly a year ago:

“So generally, outside of cannabis, you want to sell your stock when it's rich and when your stock is trading cheap, you want to sell debt. That's generally a basic principle. Now, we talked about access to capital. For a handful of industry companies, there is debt capital available, I'm not talking about the sale leaseback. Debt capital available, okay, for a handful of companies, okay? If you don't have that available, you’re just massively diluting your current shareholders and what they thought they own, they no longer in terms of percentage of the company, they no longer earn it. And they better be using that capital. I've seen transactions lately down 25%, plus you have to pay the underwriter 6%, plus they get warrants. These are massively dilutive transactions so I really want to see the use of proceeds to see down 31%, 25%-plus underwriting, where you're investing that capital and what the forward return looks like. Otherwise, you're just selling, it's like a death spiral. You just keep diluting, keep diluting until you cease to exist.”2

Ayr issued $110mm of senior secured notes (the “Notes”) in December 2020 and listed them for trading on the CSE four months later. Two-way markets exist for the debt, with market makers offering some degree of liquidity and a providing an observable record of historical trading which credit portfolio managers and risk officers love to see. I’m not aware of any other firm in the US cannabis sector that has listed their debt on a public venue, which makes me think that for some time now Ayr seems to have made a special effort to deepen its pool of potential lenders.3

The company was originally formed as a SPAC, which is a legal structure that typically conveys a 20% ownership interest to the founders at a cost basis that approximates zero.4

I think we have enough now to get back to deciphering the buyback program. The announcement’s press release reads:5

So the company is on record saying absolutely and unequivocally that the “program will in no way interfere” with its strategy or current projects. This is a level of conviction that makes no attempt to hedge against its use as evidence in any potential future shareholder litigation, and tells me they’ve done their homework to determine the specific amounts and sources of funds to meet coming needs.

The passage concludes by tying in the firm’s 2022 guidance and pointing to a detailed breakdown of how that guidance may be achieved:

This is relevant because there is an existing data point that offers insight into lenders’ tolerance for Ayr’s debt load: the Trust Indenture for the Notes contains an Incurrence of Indebtedness covenant with two tests which can be summarized as:6

A fixed charge test, by which the ratio of (a) the trailing twelve-month (“TTM”) aEBITDA to (b) a number that can be approximated as TTM interest expense must be at least 2x; and

An indebtedness test, by which the ratio of (a) the company’s total indebtedness to (b) TTM aEBITDA must be less than 4x.

So the Notes’ lender(s) got comfortable back in December 2020 (when Ayr was a substantially smaller and arguably riskier credit than today, and before the Senate flipped to Democrat control) with giving Ayr their blessing to add future debt as the company grew aEBITDA and/or reduced interest expense.

The left side of the following table shows an estimate of the two ratios over time, including looking ahead with the 2022 guidance:

We can see that the estimated total indebtedness in prior periods was a little lower than the maximum (4x) allowed by the indebtedness test, while the company was earning a lot more aEBITDA, or alternatively spending a lot less on interest, than required by the fixed charge test. And looking forward to year-end 2022, with guidance of $300mm of aEBITDA, that test would permit $1.2bn of indebtedness, or around $900mm more than the estimated amount outstanding at 6/30/21.

On the right, the maximum debt load permitted by the fixed charge test is shown for given weighted average rates of interest. At 10%, the company could potentially have up to $1.5bn of indebtedness with $300mm aEBITDA, and this test would only become the constraining factor at rates (not shown) above 12.5%.

So now the company’s mention in the announcement of both the guidance and that “debt markets that are extremely attractive and open to us” makes more sense. Still, an important question remains: what’s the incentive for the company to lever up?

To consider this, I want to revisit the fact that the insiders are predominantly ex-Wall Street and their decisions may be skewed slightly more by personal profit than passion for the plant. If they happen to want to do the trade that has the highest IRR and then pack up and move on to the next, they should want to maximize per share economics at the time of a sale that preferably occurs sooner rather than later. Let’s see how these numbers could look under various buyout scenarios:

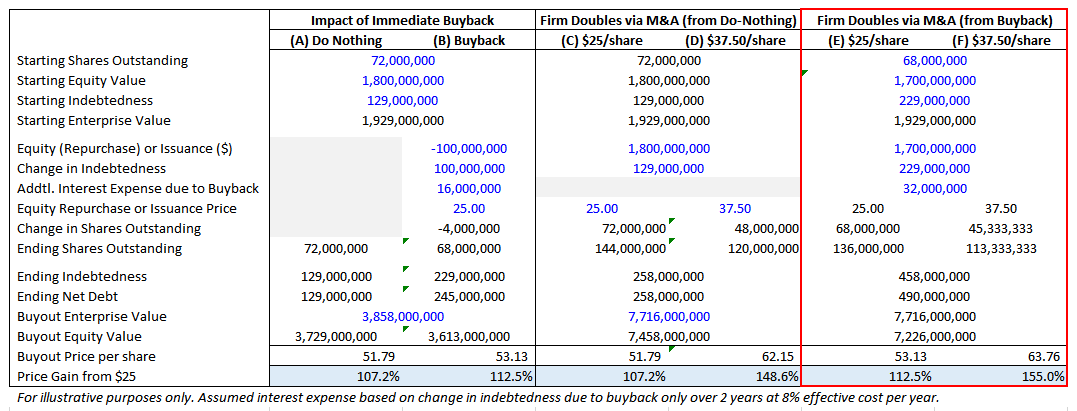

Note these calculations assume the enterprise value an acquiror is willing to pay is independent of a target’s capital structure. Given widespread use of acquisition values based on multiples of revenue or aEBITDA (both of which are determined without reference to interest expense), this may hold true today to a certain extent.

Columns (A) and (B) reflect the potential economics of a company sale for each of (A) the existing capital structure and (B) the capital structure that might follow a $100mm buyback. For illustrative purposes, the sale is assumed to occur in two years at a 100% premium to starting enterprise value, and the buyback is assumed to:

execute at a weighted average price of $25/share (coinciding with today’s assumed market price), yielding a reduction of 4mm shares outstanding;

be offset by an increase in indebtedness of $100mm to hold working capital constant, which then accrues $16mm of cash interest expense (at 8%) over the two-year period prior to the company sale. Net debt under the buyback scenario is then $116mm higher at the time of sale.

We can see the difference in expected buyout price per share and price return in the last two rows. Leverage juices the returns. In fact, the per share price gain increases by over 5 percentage points going from the do-nothing scenario to the buyback scenario.

But what if the company wants to engage in significantly more M&A of its own over this hypothetical two-year period? It’s likely to issue stock to partially or fully fund acquisitions so it should want the shares to trade to the highest multiples possible. Maybe that’s why they’ve highlighted the valuation gap to peers in recent months:7

Could the buyback be reflective of a broader effort to close the valuation gap and strengthen Ayr’s in-house currency for use in acquisitions?

To isolate the economic impact that might come from a higher valuation, columns (C) and (D) both start from the do-nothing scenario (i.e. no buyback), and then assume a doubling of the capital structure with debt and equity maintained in constant proportion:

Column (C) shows equity returns assuming issuance at $25/share while column (D) assumes $37.50/share (a 50% premium, which happens to be roughly the price gain the company has indicated would close its valuation gap to peers). The buyout enterprise value is again assumed to be at a 100% premium.

Per share economics are completely unchanged when new shares are issued at today’s price, so the returns in columns (A) and (C) are identical. But when new stock is issued at the higher price, per share buyout returns start to fly. A higher valuation enables the company to issue fewer shares as fuel for growth. The estimated per share price gain of 148% compares to 107% when stock is issued at the assumed current discount to peers.

Finally, let’s consider the combined impact of a buyback program and a subsequent doubling of the firm:

Returns in columns (B) and (E) are identical since the firm maintains a constant capital structure via issuance of shares at today assume prices. But column (F) illustrates the impact of higher starting leverage which is carried forward into the expanded capital structure. The resulting turbocharged per share returns come in at 155%, compared 107% from not doing a buyback and letting the valuation languish.

And although the table doesn’t show it, buybacks executed at lower stock prices would result in a greater reduction of shares outstanding, increasing per share returns even more. Which I think explains the following qualification in the program announcement:

If the stock price heads higher, per-share returns benefit from a more valuable M&A currency. If the price heads lower, per-share returns benefit from a more efficiently executed buyback. Win-win.

There is one more thing that makes me think the buyback is part of preparation for an eventual sale: the company recently left New York in favor of establishing its headquarters in Florida. It will be operationally helpful for management to be proximate to 25% of its revenue generation8, and who doesn’t like the beach? But if:

your cost basis is close to zero due to ownership via SPAC sponsorship,

you own a sizeable portion of the company which you expect to sell in the future for a number into the 10 (if not 11) figures, and

you want to keep as much of your sale proceeds as possible,

then the cherry on top might just be residency in a state that doesn’t have a personal income tax.

The buyback program looks like it could be part of a bigger plan. Evidence of lender tolerance for additional debt, a focus on expanding access to debt markets, some potential tax planning, and now capital structure optimization geared toward levered equity returns indicate a strategic shift in favor of debt financing, possibly with a view toward an eventual company sale.

Not to say that debt doesn’t have its downsides. A market disruption (either at the consumer/revenue level, or in the debt markets) could create a liquidity crisis for an overlevered firm. High levels of interest expense also divert cash to lenders (on a recurring basis) that otherwise could have been invested in accretive projects that compound returns over time. So leverage isn’t for everyone, and I would expect to see founder-CEOs who have a passion for the plant and who intend to indefinitely remain with their business to focus more on sustainable profits (net of interest expense) and free cashflow over managing the firm’s metrics in ways that could drive a suitor’s bid.

One other risk, at least from the perspective of common shareholders, is that a management team that has its eye on getting bought out should care not just about per share economics but also about the number of shares that they can personally accumulate prior to sale. I suspect that firms which trade at a material discount to peers while paying industry leading levels of compensation (share-based and otherwise) may need to show restraint if they want to the close the gap.

But if your goal is to reach billionaire status in short order, this approach doesn’t seem like a bad way to get there.

Subscribe to avoid missing the next issue! And follow along on Twitter for timely commentary.

DISCLAIMER

This material has been produced and distributed for informational purposes only. Sources for the information herein are believed to be reliable, but the information is not guaranteed as to accuracy and does not purport to be complete, and no representation or warranty is made that it is accurate or complete. The author undertakes no obligation to provide any additional or supplemental information or any update to or correction of the information contained herein. Securities highlighted or discussed in this communication are mentioned for illustrative purposes only and are not a recommendation to buy, sell, or otherwise transact in such securities. The author shall not be liable in any way for any losses, costs or claims arising from reliance on this material, which is not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any investment or other matter. Past performance is no guarantee of future results. Securities discussed in this material may or may not be held in portfolios owned or controlled by the author at any given time.

Source: https://ir.ayrwellness.com/company-information/management-team

Source: The Cannabis Investing Podcast “Good News for AYR Strategies”, published September 23, 2020.

Specific structure and ownership interests vary from transaction-to-transaction.

Source: https://ir.ayrwellness.com/news-events/press-releases/detail/109/ayr-wellness-announces-5-share-buyback-the-maximum; emphasis added.

Source: Trust Indenture Dated as of the 10th Day of December, 2020 available on www.sedar.com; summary descriptions provided are approximate and are not intended to precisely reflect the specific terms of the Notes.

Source: Ayr Wellness Inc. Investor Presentation dated August 2021; available from https://ir.ayrwellness.com/presentations

Based on 2022 revenue guidance and associated assumptions.